First of all, these numbers apply only to federal income taxes — which Wallace, to his credit, acknowledged. But the distinction is often elided, allowing the impression that this applies to all taxes to slide by uncontested. Rove, for instance, never mentioned it. It’s just in the fine print of the charts. And whether it gets mentioned in other contexts on Fox News, or in arguments by Republicans, is highly hit or miss.

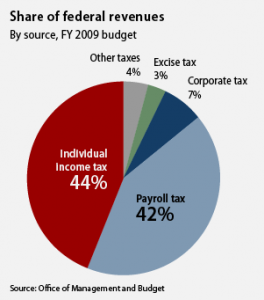

But individual income taxes made up only 44 percent of federal revenues in 2009. That same year, payroll taxes made up 42 percent of federal revenue. And in 2006, 86 percent of households with wage earners had higher payroll taxes than income taxes.

Payroll taxes apply a flat percentage rate to all of an individual’s income under $106,800, which makes payroll taxes highly regressive — i.e. the overall portion of income lost to the tax goes down as a person’s income goes up. In other words, while roughly two-fifths of the federal government’s revenue comes from progressive income taxes which fall harder on wealthier Americans, another two-fifths of that revenue comes from payroll taxes which fall harder on poorer and working class Americans.

Once state and local taxes are added, the right’s picture of the overtaxed rich deteriorates even further.